Electric Vehicle Allowance. The 2022 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member. Hmrc electric car mileage rates u.k.

5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work. The government is to extend the current 100% first year allowance for expenditure incurred on electric vehicle charge point equipment for a further four years.

For Those Of The Estimated 321,000 People In The Uk To Be Earning More Than.

The government is to extend the current 100% first year allowance for expenditure incurred on electric vehicle charge point equipment for a further four years.

Purchasing An Electric Car Through A Limited Company In The Uk Can Bring Significant Tax Advantages.

Six states only give their citizens tax advantages.

Capital Allowances Provide Businesses With Valuable Tax Relief When Investing In Electric Cars.

Images References :

Source: www.osv.ltd.uk

Source: www.osv.ltd.uk

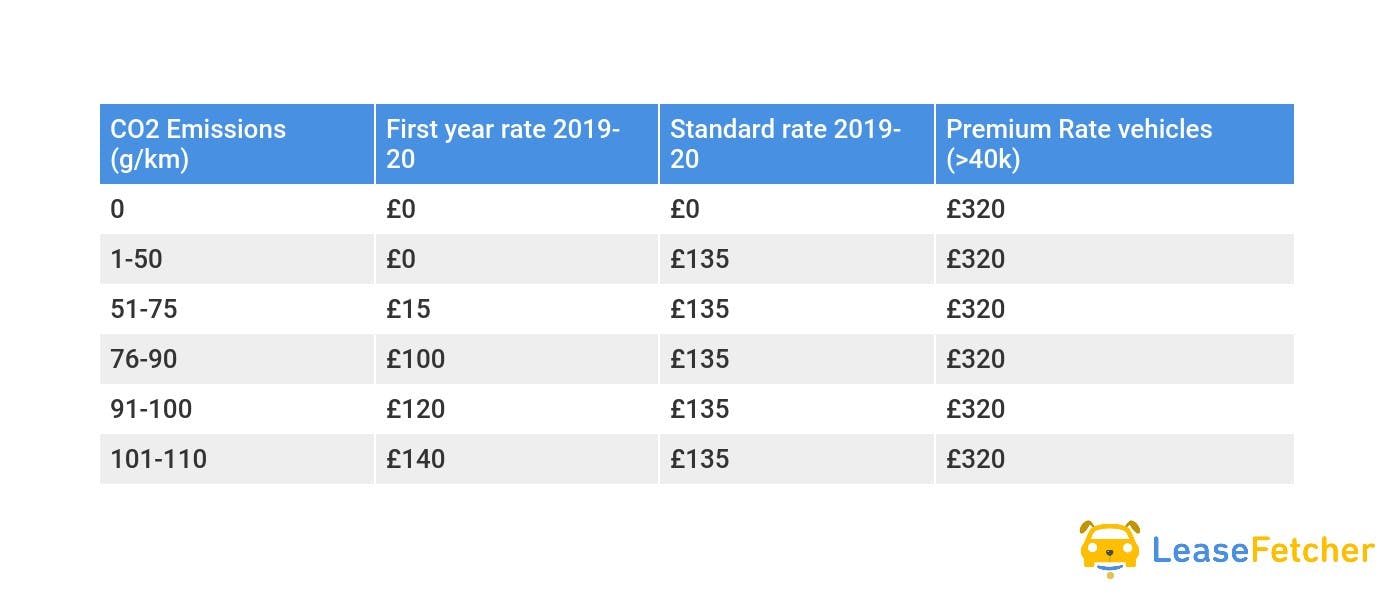

What are the capital allowances on electric cars? OSV, Car allowance is a taxable benefit and is added to your salary (usually to your monthly pay), so it gets taxed at the same rate as your salary. Cars with emissions of 75g/km or less qualify for a 100% first year allowance.

Source: www.leasefetcher.co.uk

Source: www.leasefetcher.co.uk

Company Car Tax On Electric Cars How Much Do You Pay? Lease Fetcher, Passenger payments — cars and vans. The enhanced capital allowance (eca) scheme allows.

Source: indiaonlinemart.net

Source: indiaonlinemart.net

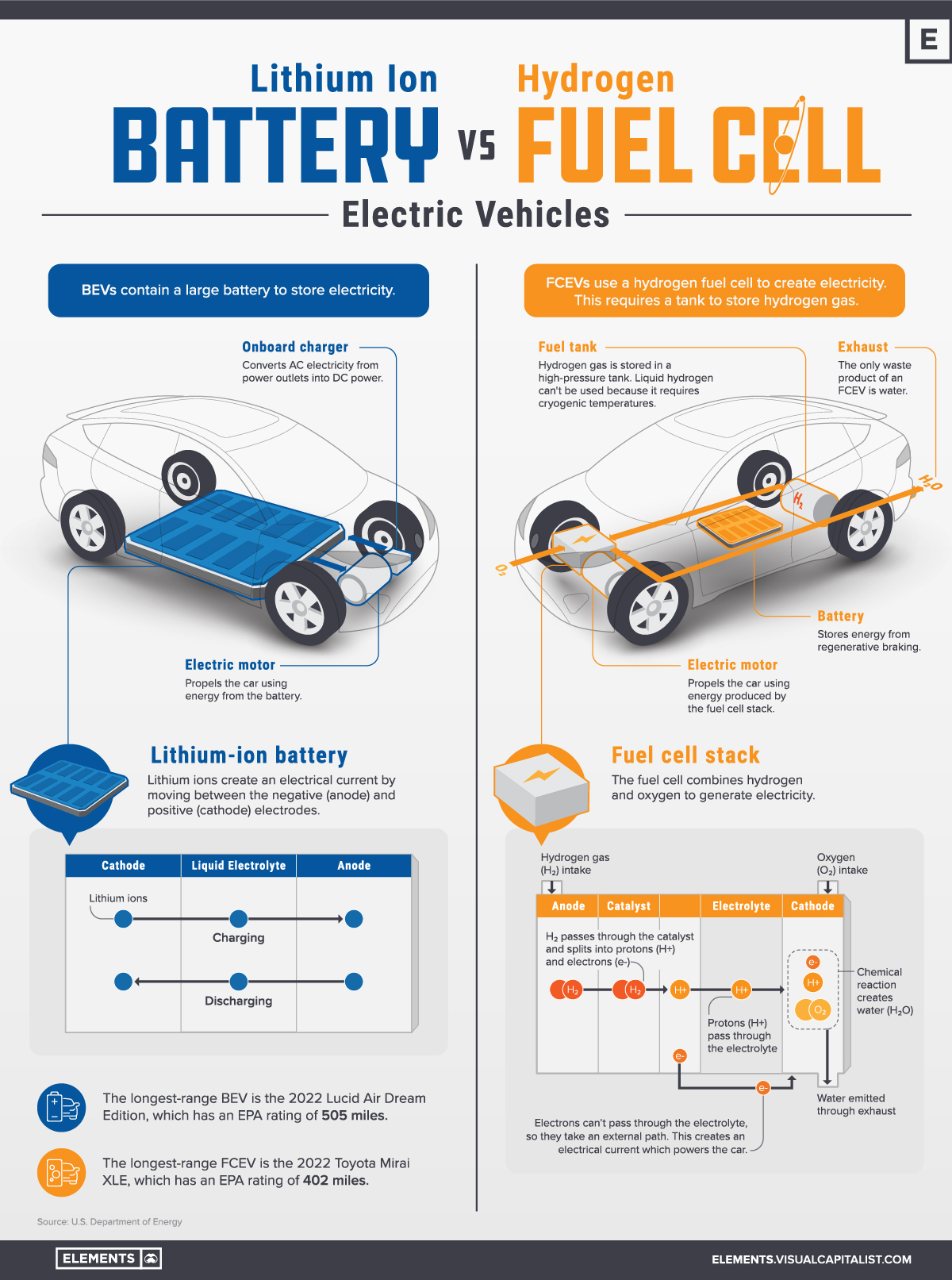

Visualized Battery Vs. Hydrogen Fuel Cell Business news, The percentage for a 0g/km vehicle for the year to 5 april 2023 is 2%. Hmrc electric car mileage rates u.k.

Source: aitaccountants.co.uk

Source: aitaccountants.co.uk

Electric Vehicles P11D, Capital Allowances & VAT Rules AIT Accountants, Car allowance is a taxable benefit and is added to your salary (usually to your monthly pay), so it gets taxed at the same rate as your salary. Capital allowances provide businesses with valuable tax relief when investing in electric cars.

Source: ngsihsewa.blogspot.com

Source: ngsihsewa.blogspot.com

Capital Allowance On Electric Cars, The 2022 update of acea’s comprehensive overview shows the fiscal measures for buying electric vehicles that are currently available in the 27 eu member. 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work.

Source: www.catax.com

Source: www.catax.com

Research & Development Tax Relief Case Study Electric Car Charging, From 1st april 2021, businesses purchasing new cars with 0g/km co2 emissions can claim. With the current electric company car mileage.

Source: carfule.com

Source: carfule.com

Fuel allowance are electric cars eligible? Car Fule, The percentage for a 0g/km vehicle for the year to 5 april 2023 is 2%. Businesses that invest in electric vehicles with zero emissions benefit from enhanced capital allowances.

Source: deborahsharan.blogspot.com

Source: deborahsharan.blogspot.com

Car allowance tax calculator DeborahSharan, Hmrc electric car mileage rates u.k. For example, if the original list price.

Source: www.knnllp.co.uk

Source: www.knnllp.co.uk

Its still possible to claim 100 tax allowance for electric vehicles, In september 2018, hmrc announced that the advisory electricity rate (aer) to be used for electric company cars is 4p per mile. Purchasing an electric car through a limited company in the uk can bring significant tax advantages.

Source: reveal-verizonconnect.skilljar.com

Source: reveal-verizonconnect.skilljar.com

Reveal Electric Vehicle Suitability Tool, For those of the estimated 321,000 people in the uk to be earning more than. From 1st april 2021, businesses purchasing new cars with 0g/km co2 emissions can claim.

But Even Between These 20 States We Can Find Big Differences.

Hmrc electric car mileage rates u.k.

Cars With Emissions Of 75G/Km Or Less Qualify For A 100% First Year Allowance.

The electric vehicle homecharge scheme (evhs) enables individual buyers of eligible evs to receive a grant for up to 75% (capped at.